News & insights

News & insights

All (91)

News & updates (15)

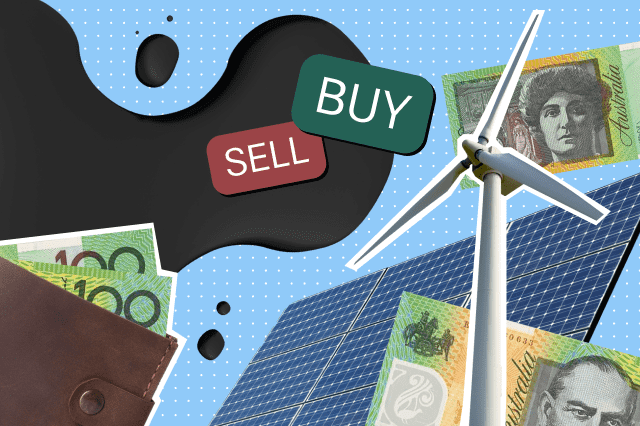

Ethical investing (30)

Climate action (18)

Animal protection (8)

Human rights & equality (5)

Super & investments (25)

Philanthropy (4)

Retirement (10)

Explore