Super with heart for employers

Award-winning# super for employers that want to support a more sustainable future, one super contribution at a time.

Empower your team with ethical super choices

We're a purpose-driven super fund with an aim to deliver long-term, risk adjusted returns for members. We invest in assets that you and your employees can be proud are contributing to a better future for everyone.

Partnering with an ethical super fund can foster employee satisfaction, align with your company or brand purpose, and support your organisation's commitment to contributing to a better and sustainable future.

![]()

Enhance employee well-being

Ethical super enhances employee well-being by fostering a workplace culture that demonstrates commitment towards social responsibility and alignment with your employees' values.

![]()

Registered MySuper option

Our Balanced investment option is a MySuper authorised product. This helps you as an employer to satisfy your compliance obligations and contribute to a better future for your employees.

![]()

7 ethical super options

Our approach focuses on ethical and responsible investments that not only seek long term financial returns but also support companies and initiatives dedicated to social, environmental, and ethical progress.

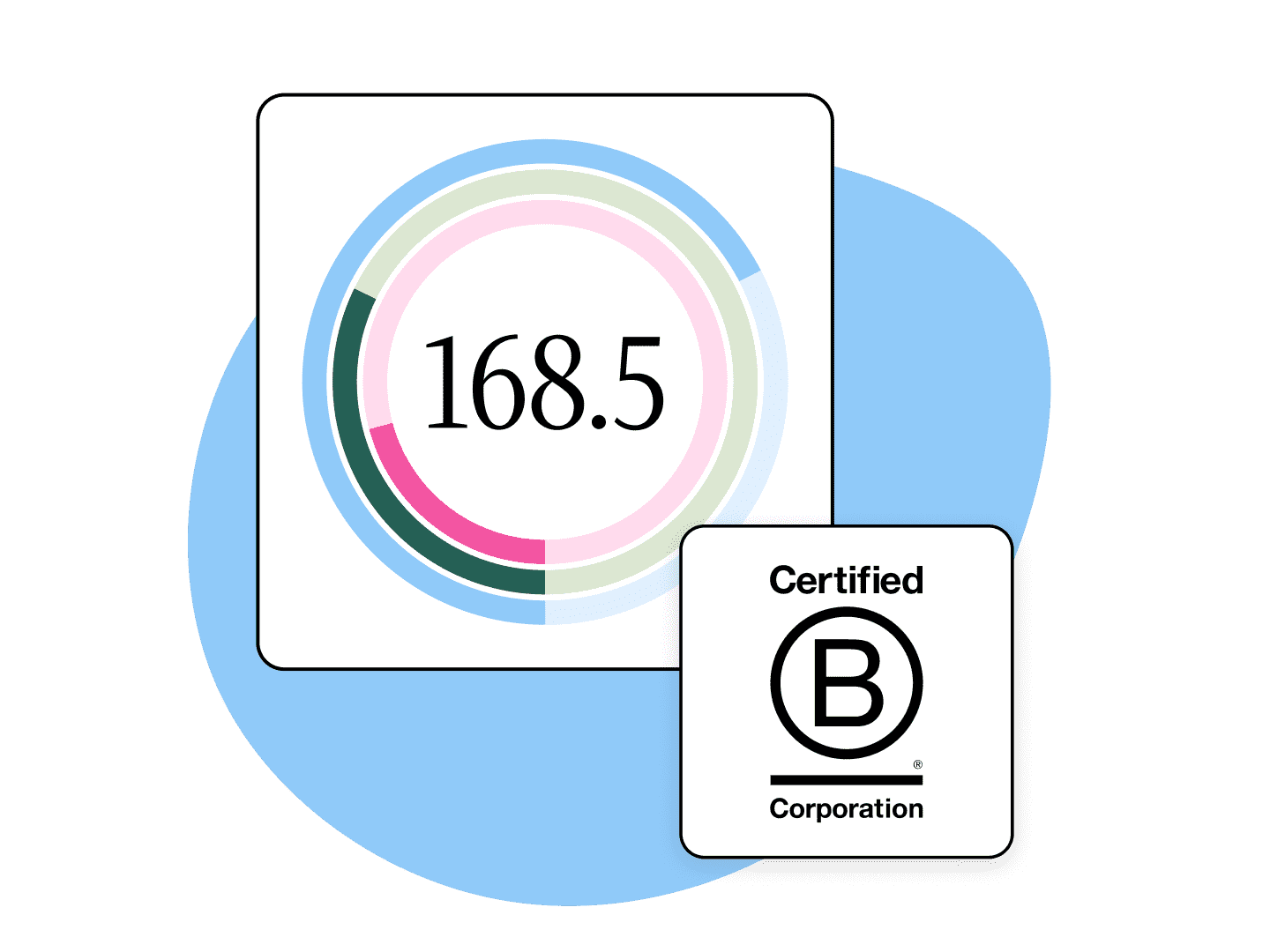

Australia's highest-rated B Corp

In 2014, we became the first listed company in Australia to earn Certified B Corporation status. Our latest score, 168.5, awarded at recertification on 13th July 2023, was the highest score for any B Corp in Australia and Aotearoa New Zealand and is more than double the score needed to gain B Corp accreditation.

Our promise to help shape a better future is brought to life through our ethical investments and our voice to advocate and engage for change.

Benefits for your employees

![]()

Flexible investment and insurance options

It is usually cheaper and more convenient to have your insurance through your super due to lower premiums and automatic premium deductions. Your employees have a range of ethical investment and insurance options to choose from.

![]()

Industry leading customer-experience

We were rated #1 in Net Promoter Score for super and customer advocacy.1 Our members have convenient online access to their accounts and a dedicated in-house member support team available to answer any queries from our members.

![]()

Measure investment returns and impact

Our members receive annual statements that not only show their investment returns but also provide an assessment of how their super has influenced positive outcomes for people, planet and animals.

Resources

Frequently used forms

ATO choice of super fund form

Letter of compliance

Award-winning super

Our award-winning# investment team has shown that an ethical approach to investing can deliver healthy* returns.

Finder Green Superannuation Fund of the Year 2020-2023

ProductReview.com.au Best Retail Super Fund

SuperRatings GOLD For MySuper and MyChoice++

Get started today

If you would like to find out more about choosing Australian Ethical as the default super fund for your employees, we’d love to hear from you.

Contact us1. Investment Trends Super Member Engagement Report May 2022 – Independent research with 23 major super funds surveying over 7,500 Australians.

++SuperRatings does not issue, sell, guarantee or underwrite this product. See the website for details of its ratings criteria. SuperRatings performance figure is net of percentage based administration and investment fees.