Stock picking in small caps – the opportunity

We are seeing an opportunity to supply capital to quality companies in this segment we know well and we’ve been watching closely as they’ve been caught up in the sell off.

Companies including Aroa Biosurgery, a regenerative soft tissue repair bio tech company, Antisense, a Phase 2 drug developer in muscular dystrophy, and Prophecy, a cyber and call centre provider. These are names we’ve recently added to our portfolios as we look for to capitalise on the small caps opportunity.

Because our ethical process naturally tilts our portfolios towards healthcare and technology companies – away from materials and industries like fossil fuels and miners outside of renewable energy – we have built strong relationships with the management teams and among companies in the smaller and micro-capitalised end of the market.

We’ve been actively talking to 60 or more companies and management teams caught up in the sell off. As interest rates peak in this cycle, we believe the opportunity will continue to improve as investors return to this segment of the market.

Multi-decade opportunity

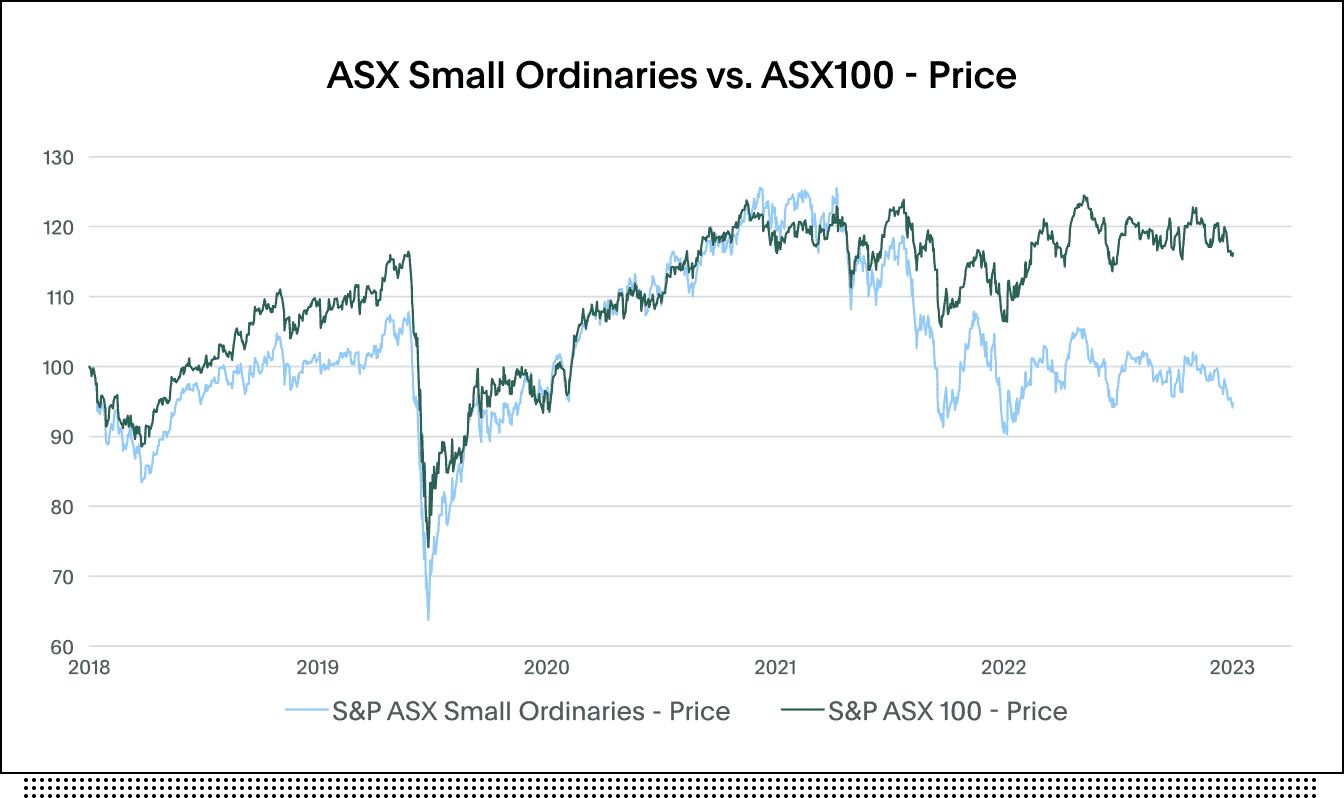

Rising interest rates in the last year and a half from almost zero to the 4.25% cash rate the Reserve Bank of Australia raised to in November has led to an unusual period of small cap versus large cap performance. It’s the most consecutive quarters where we’ve seen large caps outperform small caps in the last 20 years.

Source: Factset 18 October 2023

When interest rates and asset yields go up the way they have over the last 18 months, risk assets like equities are prone to sell offs.

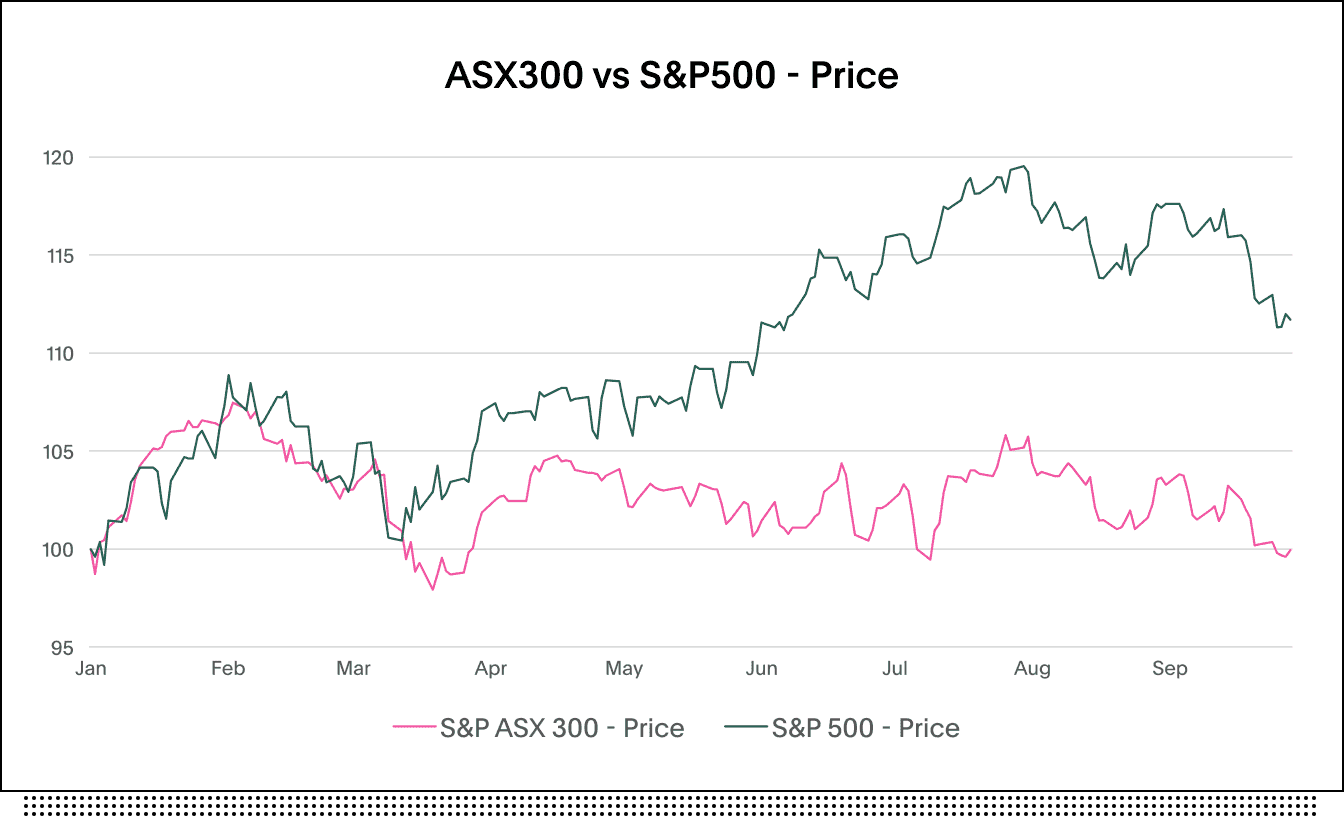

The Australian equities market as a whole has sold off, finishing the September quarter of the calendar year lower than where it started in January.

Source: Factset 18 October 2023

In small caps, the sell off has been even more pronounced. Not only has liquidity impacted small cap names, long duration assets and companies without present cashflows – many tech and early stage healthcare and biotech companies fit this description – have seen downward pressure on their public market valuations.

We believe this scenario presents an opportunity, particularly as we believe the rationale for investing in small companies hasn't changed.

These companies offer superior growth over the wider market. The combination of two years of underperformance and an interest rate cycle that looks be nearing its peak is a promising backdrop.

Cheap valuations?

We’re starting to see signs bargain hunters are coming into this part of the share market looking to acquire companies cheaply. This is an indication to us the market cycle could be reaching a turning point.

Private Equity bids for companies including software company Limeade, Australian Broadband’s acquisition of Symbio, and the Japanese conglomerate Kierin’s takeover of vitamin company Blackmores are examples of a recent spate of mergers and acquisitions.

We expect there to be continuing corporate and private equity interest in small and micro-cap companies with valuations at these levels.

More liquidity coming back to this end of the market, whether it be from dedicated small and microcap managers, all cap managers beginning to look at smaller companies again, private equity or strategic buyers, could provide a positive backdrop for investors with small caps expertise.