How we’re investing in the energy transition

Projections for electric vehicle sales speak to the size of the opportunity, as we transition our economy to renewables with the electrification of transportation.

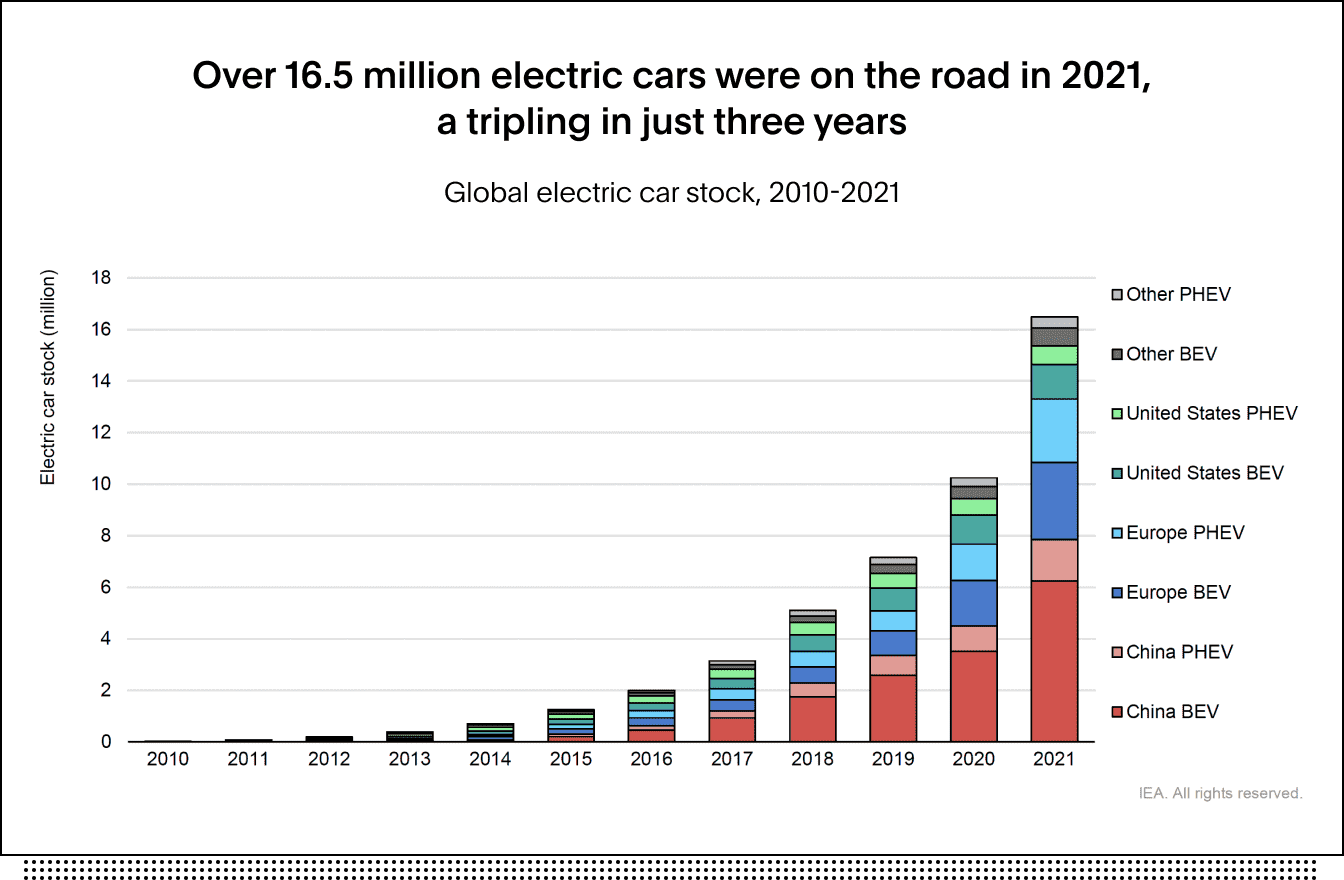

EV sales more than tripled from 2019 to 2021, and the International Energy Agency forecasts sales to increase by more than 6.6x from 2021 to 20301.

And it’s not just demand for EVs driving this global mega-trend.

New energy infrastructure including solar panels, wind turbines, as well as the electrification of transportation and grids – this is all stimulating demand for metals powering the transition, including lithium, cobalt and nickel. Prices of this group of materials have increased seven-fold in the 18 months to mid-20222.

While the headline numbers of the energy transition highlight a significant opportunity, they also carry a warning for investors seeking to generate returns and avoid risks.

There are downsides to investing in miners of materials essential to the energy transition, including human rights and land degradation issues which put shareholder capital at risk. This is particularly difficult to monitor in places such as the Democratic Republic of Congo3, for instance, where cobalt is commonly mined.

Ethical considerations can be as consequential as financial considerations when it comes to investing in the renewable energy transition, particularly when it comes to investing in miners sourcing these essential materials.

Source: Global EV Outlook 2022

Notes: BEV = battery electric vehicle; PHEV = plug-in hybrid electric vehicle. Electric car stock in this figure refers to passenger light-duty vehicles. “Other” includes Australia, Brazil, Canada, Chile, India, Japan, Korea, Malaysia, Mexico, New Zealand, South Africa and Thailand. Europe in this figure includes the EU27, Norway, Iceland, Switzerland and United Kingdom. Sources: IEA analysis based on country submissions, complemented by ACEA; CAAM; EAFO; EV Volumes; Marklines.

Australian Stock Exchange-listed companies including Pilbara Minerals, Allkem and IGO have been strong contributors to our performance in recent years, even though our allocation to energy companies is very low compared to the broader market benchmark.

While the energy and materials sectors account for close to 30% of the ASX200 index, our Australian equities portfolios will only have about a 5% weighting to these sectors.

We restrict+ investment in fossil fuel companies, and instead we are allocating capital to clean energy metals essential to making batteries and other renewable energy infrastructure.

Accelerating transition

The opportunity in renewables is strengthening as evidence continues to build, proving that dirty ways of powering our transportation and cities are becoming less economical than doing it sustainably.

This evidence points to the risks associated with investing in potentially stranded assets, but also the opportunity of moving to renewable energy sources.

It’s now cheaper to build and operate renewable energy infrastructure than it is to run existing fuel infrastructure4, and every dollar spent on dirty energy today, $1.70 is being spent on clean energy5.

Meanwhile, 1 in 3 households have rooftop solar in Australia already, and for the first time we are seeing the investment in solar exceed the investment in oil internationally6.

The evidence is mounting that we can’t continue to build new fossil fuel projects if we want to limit warming to 1.5 to remain aligned to Paris Agreement targets7.

+ Our investment restrictions include some thresholds. Thresholds may be in the form of an amount of revenue that a business derives from a particular activity, but there are other tolerance thresholds we can use depending on the nature of the investment. We apply a range of qualitative and quantitative analysis to the way we apply thresholds. For example, we may make an investment where we assess that the positive aspects of the investment outweigh its negative aspects. For information on how we make these assessments for a range of investment sectors and issues such as fossil fuels, nuclear power, gambling, tobacco, human rights, and many others, please read our Ethical Criteria.

2 Prices of raw materials such as cobalt, lithium and nickel have surged. In May 2022, lithium prices were over seven times higher than at the start of 2021