The gender gap in super

The gender pay gap extends to super balances. Women are retiring with less super than men. What steps can we take to close the gap?

Women are retiring with significantly less super than men. This inequality can leave many women vulnerable in their later years, diminishing their financial freedom and potentially limiting healthcare and aged care options.

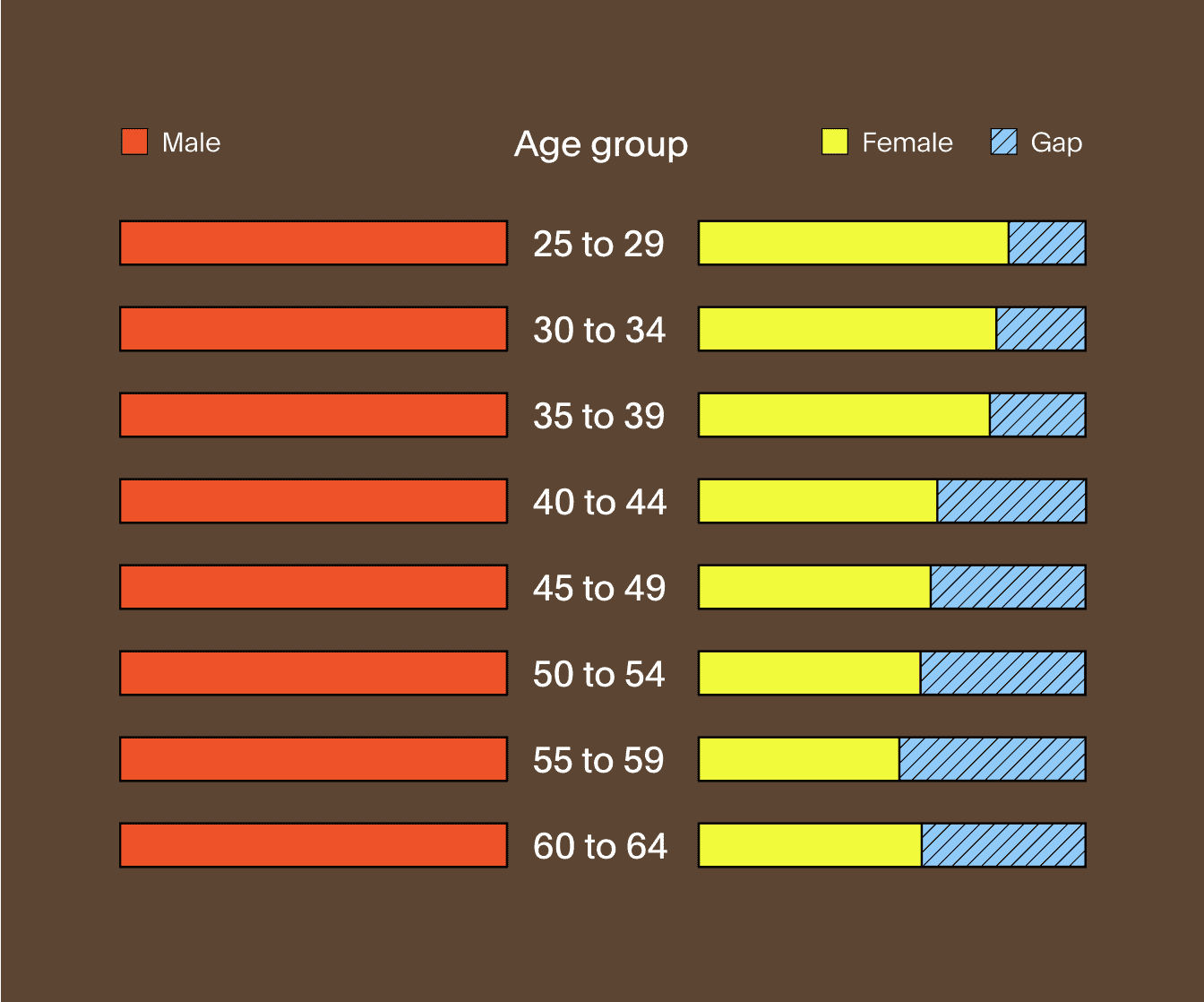

The gender gap in super exists across all age groups and is most pronounced in the years approaching retirement age.

Source: Clare, R (2017), Superannuation account balances by age and gender, October 2017, ASFA Research and Resource Centre.

What contributes to this inequality?

At the heart of the issue is the gender pay gap.

For a variety of reasons - greater levels of part-time work, working in lower-paid industries and time away from the workforce to care for children or elderly parents - Australian women generally earn less than men on average over the course of their lives.

Ultimately, lower lifetime earnings lead to lower super balances for women. Time out of the workforce not only hurts super for women but also impacts career progression and opportunities compared to their male counterparts.

With less super to invest, there are fewer returns to compound and less money to retire on.

This gender pay gap in retirement savings is exacerbated by the fact that women tend to live longer than men, so need to stretch their retirement savings further.

Ultimately, lower lifetime earnings lead to lower super balances for women. Time out of the workforce not only hurts super for women but also impacts career progression and opportunities compared to their male counterparts.

Taking action to protect your future

The retirement savings gap is a pervasive issue with roots in culture, policies, and employment practices. In the absence of systemic change, women can take action on things within their control to help close the gender gap and increase their financial security.

Small steps now can have a big impact on supporting women in the future.

-

Check how much super you’re getting. Your employer must pay at least 10.5% of your salary into your super account. Check your payslip, myGov online account and your super account (or multiple super accounts) to see employer contributions.

-

Aim to build your super balance early. Thanks to the power of compounding, building up your balance early in your working life will go a long way to boosting your balance for your retirement years.

-

Top up with voluntary contributions if you can afford to, as it can be a tax-effective way to boost your savings. You can ask your employer to pay part of your pre-tax pay into super (salary sacrifice). You can also make after-tax contributions from your take-home pay.

-

Consider consolidating your super into one to save on fees, but be mindful of any exit or withdrawal fees, tax implications or losing insurance coverage before you do.

-

Check your super investment options to make sure they are meeting your needs.

-

If you have a partner, consider if spouse contributions would make sense for you as they can make extra contributions and your spouse may receive a tax deduction.

-

Consider professional advice to help develop a plan to secure your financial future.

-

Advocate for change.

This information is general in nature and provided for informational purposes only. It is not intended to be used as investment or financial advice and does not take into account your personal financial situation, objectives or needs. You should consider obtaining financial advice that is tailored to suit your personal circumstances before making an investment decision or switching your super. Please read the Financial Services Guide and the relevant Product Disclosure Statement(s) and Target Market Determination as well as other important documentation available on our website for information about our products.